In 2026, event budgets aren’t being “cut” so much as scrutinised. CMOs are still operating at ~7.7% of company revenue, flat year-on-year and well below pre-pandemic norms, which means every line needs to prove impact.

Meanwhile, event planners say rising costs remain their No. 1 headache. The money is there, but it’s policed – and anything opaque gets questioned.

After analyzing event production decisions across 600+ companies ourselves, we discovered that most organizations are making costly mistakes by focusing only on visible costs while ignoring the most expensive element: the convergence tax.

What is the “convergence tax”?

The biggest line item isn’t on any quote. It’s decision latency – the time it takes Sales (pipeline), Marketing (demand), Product (insight) and Leadership (positioning) to align on one event strategy. That hidden friction is the convergence tax.

In 2026, latency kills ROI faster than AV rates do. The fix is economic design, not just cheaper suppliers. Strategic programs are moving that way – more flexible, productivity (and data-driven) – because finance will fund what’s measurable.

If it isn’t on the sheet, you can’t defend it. Price alignment hours, decision cycles, and the cost of delay.

In-house

Agency

Estimated total

$15k–$35k in internal time before you even brief a vendor, plus 2–4 weeks of drift.

Estimated total

$8k–$18k internal plus the fee, often offset by fewer mistakes and faster alignment.

We produced an engaging half-day conference with senior finance leaders for Celigo.

Rather than starting with a blank canvas, this matrix creates an initial vision that stakeholders can react to:

| Function | Primary Objective | Success Metric | Event Component Required |

|---|---|---|---|

| Sales | Pipeline generation | Lead volume & quality scores | Networking format, lead capture system |

| Marketing | Demand creation | Brand awareness, content amplification | Thought leadership content, social amplification |

| Product | Market intelligence | Customer feedback, competitive insights | Customer panels, demo stations |

| Leadership | Market positioning | Industry perception, partnership opportunities | Executive speaking slots, strategic announcements |

Don’t “brainstorm” – choose. Present stakeholders with three pre-built event archetypes based on the primary focus drawn from above:

A: The Pipeline Accelerator – maximise sales opportunities.

B: The Market Authority Event – position the company as an industry leader.

C: The Customer Intelligence Summit – generate deep product/customer insight.

Refinements will be made but instead of endless ideation, stakeholders can react to more concrete options – cutting alignment time by 60–75%.

Price the whole picture, not the parts.

| In-house | Agency | |

|---|---|---|

| Visible cost | Visible costs (vendors, venue, catering): $X | Agency fee: $X |

| Hidden cost | Team planning costs: $15,000-$35,000 | Client co-ordination costs: $8,000-$18,000 |

| Cost Risk/Savings | Cost of team distraction $Y | $Z savings from dealing with mistakes |

| Total | $X + ($15,000 to $35,000) + $Y | $X + ($8,000 to $18,000) - $Z |

Visible cost is the spend everyone recognises – venue, catering, and (for agencies) the fee. Hidden cost is the internal time you burn but never see on a quote: alignment, planning, iterations, and coordination. It exists with agencies too – briefing, coordination, and QC – agencies like BuyerForesight fold this cost into the agency fee itself.

The cost-risk/savings bucket is where the picture becomes clear. In-house teams pay the cost of distraction – every hour on logistics is an hour not spent driving pipeline or supporting sales. Agencies, by contrast, create a savings upside: avoided mistakes, faster execution, and smoother vendor management that translate into real financial gains.

Choose in-house when

you have a dedicated producer, alignment stays under 20 hours, frequency justifies building capability, and control is non-negotiable.

Choose an agency when

you lack specialist depth, alignment historically exceeds 40 hours, events are infrequent/complex (multi-region, large-scale), and predictability matters more than ownership.

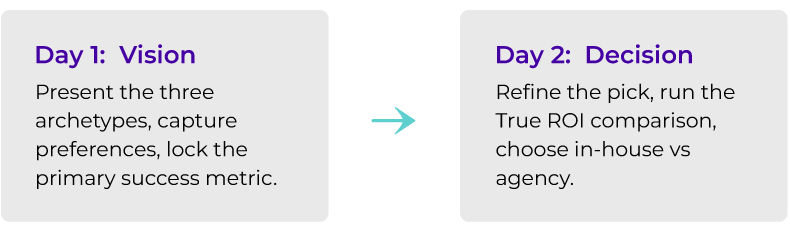

The outcome? 6 weeks of planning and logistics turns into 2 days. In the traditional production model, stakeholder alignment, reviews, iterations, and final approvals stretch across multiple cycles and weeks. In BuyerForesight’s 48-Hour Alignment Sprint, we collapse that entire sequence into Day 1 (Vision) and Day 2 (Decision).

In 2026, if your event budget can’t explain the convergence tax, it can’t defend itself. Price it. Align it. Decide fast.

If you’d like to see how this framework translates into real-world delivery, explore our approach to smarter event production.